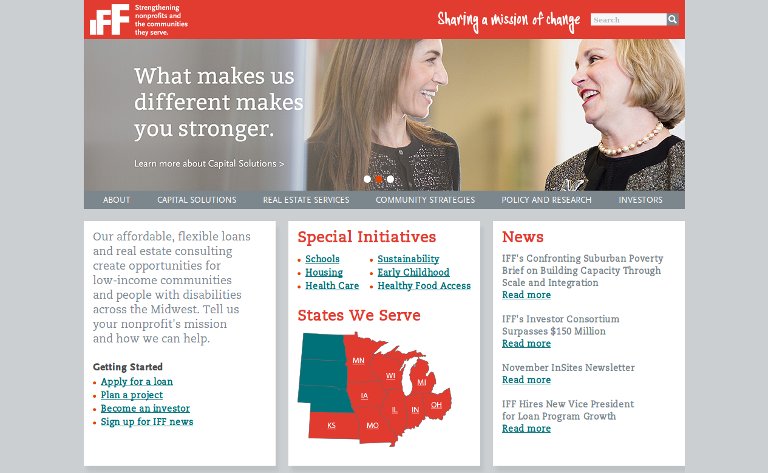

IFF provides below-market-rate real estate loans and real estate consulting to nonprofit organizations that serve low-income communities in Illinois, Indiana, Iowa, Missouri and Wisconsin. IFF was founded in 1990 around a central innovation: financing for nonprofits that otherwise couldn’t afford to own the buildings from which they deliver community services. IFF recognized that by owning facilities, these nonprofits could better serve their neighborhoods as anchors of community development. IFF analyzed traditional financing models and structured its own model around the needs and realities of this nonprofit market. IFF funding initially came from local foundations. Today it receives investments from banks, religious orders, mutual funds and foundations. Every dollar lent by IFF leverages additional outside funding. What’s more, IFF’s lending model has demonstrated that nonprofit projects are not inherently more risky, as the default rate of its portfolio is about half that of traditional lenders. Its growth strategy has enabled the organization to attract new regional and national investors that support its mission and reward its track record. Since its creation, IFF has made over 560 loans totaling more than $170 million, resulting in community facility projects valued at more than $400 million.

Website: http://www.iff.org/